businessnewscurrent.online Recently Added

Recently Added

Best Vanguard Balanced Funds

Find out which LifeStrategy Fund is best for you · LifeStrategy Income Fund · LifeStrategy Conservative Growth Fund · LifeStrategy Moderate Growth Fund. Taking the do-it-yourself route allows you to select the option or options that best meet your goals, risk tolerance and timeline. TN Balanced Fund, Vanguard. Balanced Index Fund Admiral Shares. VBIAX, %, %, %, %, %, % (11/13/), %. Balanced Index Fund. Vanguard Balanced ETF Portfolio seeks to provide long-term capital growth with a moderate level of income by investing in equity and fixed income. Vanguard Balanced ETF Portfolio seeks to provide long-term capital growth with a moderate level of income by investing in equity and fixed income. Vanguard Wellington™ Fund Investor Shares. $ VWELX ; Vanguard Balanced Index Fund Admiral Shares. $ VBIAX ; T. Rowe Price Extended Equity Market Index. Balanced Index Fund seeks-with 60% of its assets-to track the investment performance of a benchmark index that measures the investment return of the overall. People Also Watch ; VWIAX Vanguard Wellesley Income Admiral. ; VBTLX Vanguard Total Bond Market Index Fund. ; VWENX Vanguard Wellington Admiral. How to choose a balanced fund · Target Retirement Funds. If you're investing for retirement, you can get a complete portfolio in a single fund with a Vanguard. Find out which LifeStrategy Fund is best for you · LifeStrategy Income Fund · LifeStrategy Conservative Growth Fund · LifeStrategy Moderate Growth Fund. Taking the do-it-yourself route allows you to select the option or options that best meet your goals, risk tolerance and timeline. TN Balanced Fund, Vanguard. Balanced Index Fund Admiral Shares. VBIAX, %, %, %, %, %, % (11/13/), %. Balanced Index Fund. Vanguard Balanced ETF Portfolio seeks to provide long-term capital growth with a moderate level of income by investing in equity and fixed income. Vanguard Balanced ETF Portfolio seeks to provide long-term capital growth with a moderate level of income by investing in equity and fixed income. Vanguard Wellington™ Fund Investor Shares. $ VWELX ; Vanguard Balanced Index Fund Admiral Shares. $ VBIAX ; T. Rowe Price Extended Equity Market Index. Balanced Index Fund seeks-with 60% of its assets-to track the investment performance of a benchmark index that measures the investment return of the overall. People Also Watch ; VWIAX Vanguard Wellesley Income Admiral. ; VBTLX Vanguard Total Bond Market Index Fund. ; VWENX Vanguard Wellington Admiral. How to choose a balanced fund · Target Retirement Funds. If you're investing for retirement, you can get a complete portfolio in a single fund with a Vanguard.

Vanguard fans would suggest that Vanguard has the best and most The Vanguard Balanced Index Fund holds 60% Total Stock Market Index Fund and. So I'm pretty confident that things will get balanced really soon in case of a market crash. Vanguard FTSE ETF is now the most expensive fund. Best Vanguard Index Funds · 1. Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) · 2. Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX) · 3. One of the most recommended Vanguard funds in the ChooseFI community is VTSAX. It's a total stock market fund, which means you invest in the entire U.S. stock. Our pick for the best Vanguard mutual fund is VTWAX. This fund features diversification among more than 9, large-, mid- and small-cap stocks from U.S. Our pick for the best Vanguard mutual fund is VTWAX. This fund features diversification among more than 9, large-, mid- and small-cap stocks from U.S. Vanguard Wellington (65% stock) or Vanguard Balanced Fund (60% stock). businessnewscurrent.online Let me know if you. Use the dropdown filters and search bar to start to compare funds. Fund family. Vanguard funds Invesco Great Wall Fund Mgmt Co. Ltd Invesco Investment. But a very popular fund that's among the best Vanguard ETFs overall is the Vanguard S&P ETF (VOO). As the name implies, this exchange-traded fund is. Vanguard Product Options Tree - Money Market - CDs and Bonds - Stocks - ETFs -. Know exactly what you're looking for? Explore our great ETF & mutual fund. Each of the Target Retirement Funds invests in Vanguard's broadest index funds, giving you access to thousands of U.S. and international stocks and bonds. Vanguard S&P ETF (VOO). Overview: As its name suggests, the Vanguard S&P tracks the S&P index, and it's one of the largest funds on the market with. VBIAX | A complete Vanguard Balanced Index Fund;Admiral mutual fund 7 Great Retirement Funds To Consider For Those 50+ and Planning for Feb. Fidelity Go was awarded Best Robo out of ten online brokers based on the results from their annual online brokers and trading platforms survey. Research. A positive alpha figure indicates the portfolio has performed better than its beta would predict. Vanguard funds are managed by Vanguard Investments Canada. The Vanguard Wellesley Income Admiral, the Vanguard Tax-Managed Balanced Fund Admiral, and the Vanguard High-Yield Tax-Exempt Fund are all popular vanguard. Provides access to Vanguard's best investment thinking, in a ready-made portfolio that makes investing simple for you. Invest directly with Vanguard Personal. VIIIX, VBMPX, VEMPX, VIGIX, VSMAX, VVIAX, VTAPX, VTPSX, VMVAX, VSISX, VMIAX, VEMIX, VGSNX, VFTAX, and then various target date funds. Much. Vanguard Balanced Index Fund Admiral Shares VBIAX:NASDAQ · Key Stats · Latest On Vanguard Balanced Index Fund Admiral Shares · Content From Our Affiliates. Vanguard Balanced Index Fund (VBIAX) · Performance Overview · Trailing Returns (%) Vs. Benchmarks · Annual Total Return (%) History · Show More · Past Quarterly.

Ceridian Dayforce Direct Deposit

When I checked my dayforce account, it says I should be getting paid today. However it says the amount next to "check" and $0 next to my direct deposit. Direct Deposit. Page Change your banking information. Page 2. How to Login to Ceridian Dayforce. Page 2 of HOW. With the Edit Direct Deposit feature, you can conveniently add, edit, and change the order of your direct deposit pay and compensation accounts. Overview. Ceridian Dayforce is a full suite HRIS system that can serve as a one-stop-shop for companies, covering everything from payroll, benefits and. ADP · Direct Deposit Switch · Payroll Data Sync · Ceridian Dayforce · Direct Deposit Switch · Payroll Data Sync · Gusto · Direct Deposit Switch. Use the app to add your available earned pay to the Dayforce Wallet Mastercard® at the end of your workday. You can even have your regular paycheck direct. Go to “Profile and Settings,” then choose the “Forms” tab. Scroll down to access “Direct Deposit.” Contacts. Human Resources. Direct Deposit form updates details for direct deposit of pay and other compensation. You can provide details for multiple bank accounts, and control how. Using the Direct Deposit form, employees can enter details for direct deposit of pay and other compensation. When I checked my dayforce account, it says I should be getting paid today. However it says the amount next to "check" and $0 next to my direct deposit. Direct Deposit. Page Change your banking information. Page 2. How to Login to Ceridian Dayforce. Page 2 of HOW. With the Edit Direct Deposit feature, you can conveniently add, edit, and change the order of your direct deposit pay and compensation accounts. Overview. Ceridian Dayforce is a full suite HRIS system that can serve as a one-stop-shop for companies, covering everything from payroll, benefits and. ADP · Direct Deposit Switch · Payroll Data Sync · Ceridian Dayforce · Direct Deposit Switch · Payroll Data Sync · Gusto · Direct Deposit Switch. Use the app to add your available earned pay to the Dayforce Wallet Mastercard® at the end of your workday. You can even have your regular paycheck direct. Go to “Profile and Settings,” then choose the “Forms” tab. Scroll down to access “Direct Deposit.” Contacts. Human Resources. Direct Deposit form updates details for direct deposit of pay and other compensation. You can provide details for multiple bank accounts, and control how. Using the Direct Deposit form, employees can enter details for direct deposit of pay and other compensation.

Enter Direct Deposit Information If employees belonging to the pay group are paid by direct deposit, you can enter additional direct deposit settings for. OPTION #2 – Complete and Submit the attached DAYFORCE WALLET DEPOSIT FORM Log in to Ceridian/Dayforce: URL: businessnewscurrent.online DayForce profile and gather the routing and account number of your Pay Direct Deposit Information. This is your current direct deposit information. Experience the power of spending or managing your money as soon as you earn it. Dayforce Wallet gives you on-demand access¹ to your available earned pay. To enter in, update, or remove direct deposit information in Ceridian Dayforce HCM follow the below steps. 1. Profile & Settings. 2. Forms. Payroll Direct Deposit Information HR professionals, managers, and payroll professionals can view and update an employee's bank account information in the. provides Payroll Payments through Ceridian's. Dayforce Software Use this Submitting your direct deposit information – suggested iii. Updating your. Submit Direct Deposit Information (US) To submit a US Direct Deposit form: Go to People, open the employee profile, click Forms, and then click Direct. Direct Deposit · Click +Add · Choose Account Type: Checking, Savings, Payroll Card · Routing Number: (Must be 9 digits) · Enter Account Number. Reenter Account. Congratulations. Dayforce is here to make your work life better. Stay connected to your workplace with the Dayforce mobile app. Save time, reduce paperwork. In the Dayforce Wallet app, select Account. · Under Banking, select Direct Deposit. · Tap Edit. · Choose the Full Amount, Set Amount, or Percentage of each. You can also have your pay automatically deposited to your Dayforce Wallet Card each pay period by setting your card account up for direct deposit. You can have. Add a Dayforce Card to Direct Deposit for Canadian Employees Before You Begin: Employees must first complete Dayforce Wallet registration. If an employee requests that their payment be divided and paid into more than one account, click Add Additional Deposit. Ceridian can make direct deposits to a. We've partnered with ADP and Dayforce to offer payroll solutions for businesses of all sizes. Direct Deposit - Enhance employee satisfaction by offering. bank account information used for payroll direct deposits. See Payroll Direct Deposit Information. An employee can have parts of their pay deposited in. Using this system, contract employees may access pay stubs, enroll in Direct Deposit, obtain year-end tax forms, and enroll in benefits once eligible. If your company has been approved for direct deposits, you must enter your employees' banking data and payment instructions into Powerpay for your employees to. From and To dates: Select the beginning and end of the date range to report on. Committed Payrun Only: Select this option and Dayforce includes data from. M posts. Discover videos related to How to Set Up Direct Deposit on Dayforce on TikTok. See more videos about How to Set Direct Deposit for Claires.

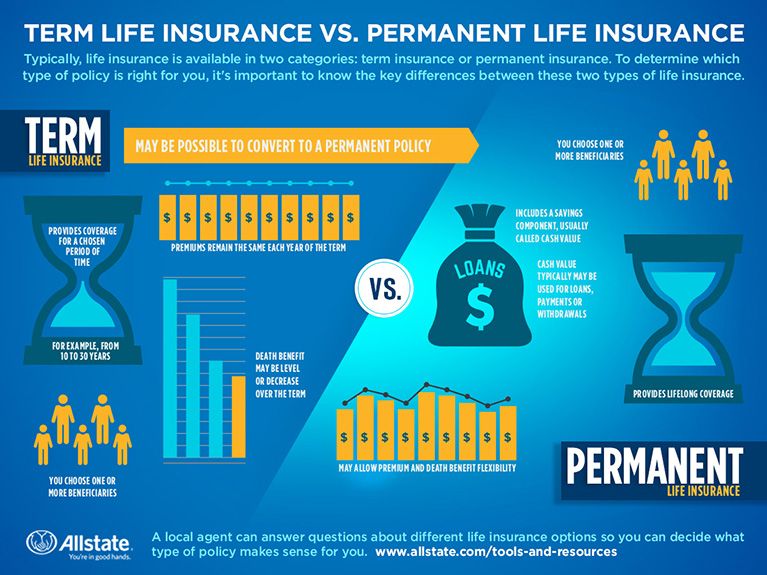

Is Permanent Life Insurance Worth It

Because of the savings element, premiums are generally higher for permanent than for term insurance. However, the premium in a permanent policy remains the same. Buying Life Insurance · Variations of Term Life Policies · Cash Value · Dividends · You can use dividends in several ways: · Whole Life Policies with Investment. The answer is that most people would be better off getting a term policy and putting the rest of their money in other types of tax-free investments. What makes permanent life policies unique is their ability to provide additional worth through cash value. You are able to access the money through loans or. If you now have the means to upgrade to a longer-lasting policy, a conversion may be the answer. People with a high net worth, who have a complex financial. As a rule, term policies are cheaper than permanent policies because they don't have savings or investment components, known as cash value. They are also. If you want a life insurance policy that lasts a lifetime and builds cash value, permanent life insurance may be worth considering. However, this type of policy. Permanent life insurance is generally more expensive than term insurance, but you can put it to use as a financial tool during your lifetime. * Permanent life insurance can be a useful tool for planning inheritance for your heirs. (There are other methods that don't involve permanent insurance, but. Because of the savings element, premiums are generally higher for permanent than for term insurance. However, the premium in a permanent policy remains the same. Buying Life Insurance · Variations of Term Life Policies · Cash Value · Dividends · You can use dividends in several ways: · Whole Life Policies with Investment. The answer is that most people would be better off getting a term policy and putting the rest of their money in other types of tax-free investments. What makes permanent life policies unique is their ability to provide additional worth through cash value. You are able to access the money through loans or. If you now have the means to upgrade to a longer-lasting policy, a conversion may be the answer. People with a high net worth, who have a complex financial. As a rule, term policies are cheaper than permanent policies because they don't have savings or investment components, known as cash value. They are also. If you want a life insurance policy that lasts a lifetime and builds cash value, permanent life insurance may be worth considering. However, this type of policy. Permanent life insurance is generally more expensive than term insurance, but you can put it to use as a financial tool during your lifetime. * Permanent life insurance can be a useful tool for planning inheritance for your heirs. (There are other methods that don't involve permanent insurance, but.

Permanent life insurance is ideal for protection and coverage needs without a specific end point. It can help your family, your business, and you. With a policy. A permanent life insurance policy can be anywhere from five to 15 times more expensive than a comparable term life insurance policy. The cost of life insurance. Term policies are typically written for one, five, ten or twenty years. This type of life insurance is typically less expensive in your younger years than. Permanent life insurance is our signature product. It can provide money to your family when you die, and can build cash value while you live. While term life insurance is initially less expensive, permanent life insurance may be more efficient in the long run. Permanent life insurance, on the other hand, provides lifetime coverage, making it suitable for estate planning. However, such coverage can come at a steep cost. Universal Life Insurance is a flexible policy that allows you to customize both the timing and amount of your premium. Lifetime protection and potential for. Permanent life insurance lasts your whole life, usually carries a cash value component you can tap into if needed, and is often more expensive than term life. Whole life insurance is a good solution for retirement and for safeguarding your assets Whole life policies are guaranteed to build cash value over time, and. Life insurance provides a financial safety net to your beneficiaries, business, or estate after you pass away, so it can be a good investment if you have a lot. You want lifelong coverage: Whole life insurance provides permanent coverage that spans your entire lifetime, as long as premiums are paid. It can be suitable. Is whole life insurance worth the cost? Like any other financial product, whole life has advantages and disadvantages, along with some unique features. It. On the other hand, term life insurance only lasts for a specific amount of time and is typically less expensive.5 This policy may be a good option if you have. Whole life insurance is worth buying for many people. While it's typically more expensive than term life insurance, as long as your premiums are paid, it offers. Life insurance with a cash value component could be worthwhile if you want to have the benefit of permanent coverage combined with the ability to access the. Two advantages of permanent life insurance are that the premium amount generally remains level through the insured's lifetime, and also the guaranteed-savings. Permanent life insurance, which includes whole life, universal life and variable universal life, gives you lifelong coverage 1, and builds cash value that you. But if you have a lot of debt, you may opt for a high-value term life insurance policy until the debt is paid down. If you don't need a large death benefit, a. Permanent life insurance policies offer a death benefit and cash value. The death benefit is money that's paid to your beneficiaries when you pass away. Life insurance can provide an effective safety net to protect against financial loss arising from your death somewhere along that path. Life insurance comes in.

Which Is The Best Bank For Credit Card

We analyzed the most popular Bank of America cards to find the best travel cards, cash-back cards, business cards and more. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. We are sharing information and educational resources about how you can align your money with your values and find better banks, credit unions, and credit cards. NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of – from generous rewards and giant sign-up bonuses. Best no-annual-fee credit cards · Chase Freedom Flex℠: With no annual fee, you won't have to pay for bonus cash back. · Chase Freedom Unlimited®: For a card with. The Bank of America® credit card comparison tool lets you compare credit cards side by side to find the card that's right for your lifestyle. From unlimited cash back on all purchases to low intro rates and no annual fees, 2,3,6 it's time to reward yourself with a Fifth Third credit card. The Wells Fargo Reflect card has the best credit card rates right now, offering introductory APRs of 0% for 21 months from account opening on new purchases. We analyzed the most popular Bank of America cards to find the best travel cards, cash-back cards, business cards and more. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. We are sharing information and educational resources about how you can align your money with your values and find better banks, credit unions, and credit cards. NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of – from generous rewards and giant sign-up bonuses. Best no-annual-fee credit cards · Chase Freedom Flex℠: With no annual fee, you won't have to pay for bonus cash back. · Chase Freedom Unlimited®: For a card with. The Bank of America® credit card comparison tool lets you compare credit cards side by side to find the card that's right for your lifestyle. From unlimited cash back on all purchases to low intro rates and no annual fees, 2,3,6 it's time to reward yourself with a Fifth Third credit card. The Wells Fargo Reflect card has the best credit card rates right now, offering introductory APRs of 0% for 21 months from account opening on new purchases.

Bank of America Preferred Rewards® members earn 25%% more cash back on every purchase. That means the 3% choice category could earn % - % and the 2%. Citi Simplicity® Card · Rewards · Welcome bonus · Annual fee · Intro APR · Regular APR · Balance transfer fee · Foreign transaction fee · Credit needed. If you want just one card both the Discover IT and the Capital One Savor One are both good choices people mentioned. Just to be fun I'd like to. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. Featured Partner Offers ; By Type. All Top Credit Cards · Business Credit Cards ; By Issuer. Citi Credit Cards · Chase Credit Cards ; By Credit Score. Credit Cards. The Bank of America® credit card comparison tool lets you compare credit cards side by side to find the card that's right for your lifestyle. Stay on top of where and how much your child can spend. You can set limits on where and how much your child can spend or withdraw from ATMs. Within your set. Credit Cards ; BEST FOR EVERYDAY CASH REWARDS. Wells Fargo Active Cash® Card · on Wells Fargo's secure site ; BEST STARTER TRAVEL CARD. Chase Sapphire Preferred®. Farm Bureau Bank proudly serves members across the country, delivering a banking experience tailored specifically for the Farm Bureau® family. Top Credit Card Links Top Credit Card Links. Credit Card Home · Application Choose from these Bank of America® credit cards to find the best fit. We. Selecting a credit card. Choosing a credit card can be overwhelming. We've compiled some important considerations to help you pick the best credit card for you. There's no such thing as a “best credit card for everybody” — but everybody can find a card that's right for them. The best credit card for you might be a cash-. A lower interest rate credit card can help you save on the cost of debt by making it easier to pay down your balance faster. Save money on interest and apply for a Bank of America® credit card with a low intro APR on purchases. Best Credit Cards · Best Overall: Capital One Quicksilver® Cash Rewards Credit Card · Best for Cash Back: Capital One Quicksilver® Cash Rewards Credit Card · Best. Compare the best Bank of America cards · Annual fee: $0. · Rewards: % cash back on purchases. · Welcome bonus: $ cash rewards bonus after spending $1, Credit cards offer better consumer protections against fraud compared with debit cards linked to a bank account. Newer debit cards offer more credit card. Bank of America offers credit cards featuring benefits from travel and cash back to an exceptional suite of services and experiences. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at businessnewscurrent.online Best Credit Cards · Best Cash Back Credit Cards · Best Rewards Credit Cards · Best Best Bank Account Bonuses · Best Banks · Loans · Best personal loans · Best.

What Are Stock Shares

An individual unit of stock is known as a share. For example, if you were to say, "I own stock in Apple (AAPL %)," it tells us that you are invested in. Equities - Shares issued by a company which represent ownership in it. Ownership of property, usually in the form of common stocks, as distinguished from fixed-. What are stocks? Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.”. Stock is a share in the ownership of a company. Stock represents a claim on the company's assets and earnings. Shares of stock are the units of ownership of business corporations. When a corporation is formed, it is allowed to issue up to a certain number of shares. Common stocks represent ownership shares in a company. When you buy common stocks, you're actually buying a small part of the company that issued it. As an. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what. A share of stock is a unit of ownership in the business. The number of shares determines how big of a piece of ownership in a business you have. Shares represent a unit of ownership in a specific company, while stocks refer to the general ownership in one or more companies. Knowing these differences can. An individual unit of stock is known as a share. For example, if you were to say, "I own stock in Apple (AAPL %)," it tells us that you are invested in. Equities - Shares issued by a company which represent ownership in it. Ownership of property, usually in the form of common stocks, as distinguished from fixed-. What are stocks? Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.”. Stock is a share in the ownership of a company. Stock represents a claim on the company's assets and earnings. Shares of stock are the units of ownership of business corporations. When a corporation is formed, it is allowed to issue up to a certain number of shares. Common stocks represent ownership shares in a company. When you buy common stocks, you're actually buying a small part of the company that issued it. As an. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what. A share of stock is a unit of ownership in the business. The number of shares determines how big of a piece of ownership in a business you have. Shares represent a unit of ownership in a specific company, while stocks refer to the general ownership in one or more companies. Knowing these differences can.

Plain and simple, stock is a share in the ownership of a company. Stock represents a claim on the company's assets and earnings. As you acquire more stock, your. Key Evaluation Ratios · Earnings per share (EPS): Calculated by dividing a company's total earnings by the number of shares, a company's earnings per share. For example, instead of a stock trading at $1, per share, a for-1 stock split would allow it to trade for $ per share (FIGURE 1) while the number of. Trade stocks with E*TRADE from Morgan Stanley. Easy-to-use tools, free research, and personalized guidance mean you never have to face the markets on your own. Stocks, shares and equities are terms used to describe units of ownership in one or more companies. The owner – known as a shareholder – will receive. 'Stock' refers to part-ownership in one or more companies, the term 'share' has a more specific meaning. 'Share' refers to the unit of ownership in a single. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. What are shares? Companies issue shares as a means to raise money. This may be to finance company expansion, a new development, or to move into overseas markets. A share price – or a stock price – is the amount it would cost to buy one share in a company. The price of a share is not fixed, but fluctuates according to. A share is the unit of stock; the more shares you buy, the more stock you have in a company. Stocks are issued by companies to raise money to grow their. What is Stocks. Definition: A stock is a general term used to describe the ownership certificates of any company. A share, on the other hand, refers to the. A shareholder may also be referred to as a stockholder. The terms “stock,” “shares,” and “equity” are used interchangeably in modern financial language. The. Investing Lists. Actionable investing lists allow you to find the types of stocks that align best with your investment strategy. Information provided by VALIDEA. There are two main types of stocks: common stock and preferred stock. Common Stock. Common stock is, well, common. When people talk. The Takeaway. The difference between stocks and shares is that a share represents a unit of ownership in a company, while stocks refer to the ownership of one. Common stock is a type of security that represents ownership of equity in a company. There are other terms – such as common share, ordinary share. The basis of stocks or bonds you own generally is the purchase price plus the costs of purchase, such as commissions and recording or transfer fees. Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the shares by which ownership of a corporation or company is divided. Our Exchanges · NYSE. With the most consistent auction performance, the most displayed shares at the NBBO, and the narrowest quoted bid / ask spreads, NYSE is.

Permanent Life Insurance Worth It

A permanent life policy provides lifelong insurance protection. The policy pays a death benefit if you die tomorrow or if you live to be There is also a. The cash value: permanent life policies, like whole life insurance, have a cash value component that builds over time and can be cashed out or borrowed against. It's not as much as a scam as it is "not the best use for the money". Typically you're far better off buying term insurance and investing the difference. Fidelity Life's range of permanent whole life insurance products offer lifelong coverage and level premiums. Permanent life insurance lasts your whole life, usually carries a cash value component you can tap into if needed, and is often more expensive than term life. Whole life insurance offers the benefit of permanent protection as long as you maintain payments on time. And while payments may be higher than term life, whole. * Permanent life insurance can be a useful tool for planning inheritance for your heirs. (There are other methods that don't involve permanent insurance, but. With cash value life insurance, a portion of your policy earns interest and could be available for you to withdraw in case of an emergency. You can learn more. But if you're wondering whether a permanent policy is a good way to receive tax-free investment benefits while you're alive, the answer is that most people. A permanent life policy provides lifelong insurance protection. The policy pays a death benefit if you die tomorrow or if you live to be There is also a. The cash value: permanent life policies, like whole life insurance, have a cash value component that builds over time and can be cashed out or borrowed against. It's not as much as a scam as it is "not the best use for the money". Typically you're far better off buying term insurance and investing the difference. Fidelity Life's range of permanent whole life insurance products offer lifelong coverage and level premiums. Permanent life insurance lasts your whole life, usually carries a cash value component you can tap into if needed, and is often more expensive than term life. Whole life insurance offers the benefit of permanent protection as long as you maintain payments on time. And while payments may be higher than term life, whole. * Permanent life insurance can be a useful tool for planning inheritance for your heirs. (There are other methods that don't involve permanent insurance, but. With cash value life insurance, a portion of your policy earns interest and could be available for you to withdraw in case of an emergency. You can learn more. But if you're wondering whether a permanent policy is a good way to receive tax-free investment benefits while you're alive, the answer is that most people.

Permanent life insurance policies offer a death benefit and cash value. The death benefit is money that's paid to your beneficiaries when you pass away. "A life insurance payout can keep your heirs from having to rush to sell those assets, potentially at below-market valuations," Austin says. Even if your estate. This is the most common type of permanent life insurance, which, in addition to a death benefit, offers the policy holder the ability to accumulate cash value. This saves you money on premiums but reduces your death benefit. In some cases, especially where your health is still good, simply buying another term life. Permanent life insurance policies provide lifelong coverage -- even if you live to , the policy will pay a benefit as long as premiums are paid. So even if you are young and single and do not need life insurance now, purchasing whole life insurance is a worthwhile investment for when you do need it down. With universal life, both the premium and death benefit can be adjusted, allowing the policyholder some financial flexibility should their budgets or needs. Tax-free death benefits The beneficiary of a permanent life policy receives a guaranteed death benefit when the policyholder passes away. · Build cash value A. Because of the cash value element, permanent life insurance can be a valuable asset for long-term financial planning. In fact, some permanent life insurance. This saves you money on premiums but reduces your death benefit. In some cases, especially where your health is still good, simply buying another term life. Your whole life premium stays the same for life. The fixed premium of a term insurance policy typically ends after 10, 20, or 30 years. · You build cash value at. Some of the major pros of permanent life insurance are that it offers a cash value component and lasts indefinitely. Permanent life insurance plans also offer a. In addition, permanent life insurance can be a financial tool that can help you build wealth and accumulate cash value to use during your lifetime. Let's look. Whole life insurance is a type of “permanent” life insurance designed to provide lifelong coverage. Benefits can include an income tax-free death benefit. How long is it worth keeping a whole life policy? · Guaranteed death benefit: Since the death benefit on a whole life policy is % guaranteed, keeping your. Permanent life insurance offers lifelong coverage so long as you pay your premiums · Most permanent life insurance policies include a cash value component that. A term life insurance policy pays out if you die during the policy term. · A cash-value insurance policy is permanent life insurance. Because of the cash value element, permanent life insurance can be a valuable asset for long-term financial planning. In fact, some permanent life insurance. Unlike term coverage, this type of life insurance does not expire, provided you keep making the premium payments. Those premiums generally stay the same. Like all life policies, your beneficiaries will receive the death benefit of the policy at the time of your death. This can be paid out in a lump sum or in any.

Best Lenders For Small Business Loans

Credibly business loan: Best for poor credit. · OnDeck business loan: Best for customer experience. · American Express® Business Line of Credit: Best for lower. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. OnDeck is an online lender specializing in small business loans. Its products include term loans and business lines of credit, which are available in 49 states. Get fast, affordable business loans online through Funding Circle. SBA 7A, PPP, Term Loans & more - we'll help you find the right loan for your small. SBA loans are available in amounts from less than $50, to as high as $5 million, you'll get lower rates and favorable repayment terms. Most SBA loan programs. Some of these loans may be applied for through the U.S. Small Business Administration (SBA), however, you can also apply for small business loans through. Explore our small business financing options and find out how to use small business loans and credit to finance your business needs. Get more information. With billions funded and a top rating from the Better Business Bureau, it's no wonder so many small business owners trust OnDeck as their lender of choice. Best for multiple types of loans: Biz2Credit · Best for same-day funding: OnDeck · Best for no prepayment fees: Funding Circle · Best for microloans: Kiva. Credibly business loan: Best for poor credit. · OnDeck business loan: Best for customer experience. · American Express® Business Line of Credit: Best for lower. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. OnDeck is an online lender specializing in small business loans. Its products include term loans and business lines of credit, which are available in 49 states. Get fast, affordable business loans online through Funding Circle. SBA 7A, PPP, Term Loans & more - we'll help you find the right loan for your small. SBA loans are available in amounts from less than $50, to as high as $5 million, you'll get lower rates and favorable repayment terms. Most SBA loan programs. Some of these loans may be applied for through the U.S. Small Business Administration (SBA), however, you can also apply for small business loans through. Explore our small business financing options and find out how to use small business loans and credit to finance your business needs. Get more information. With billions funded and a top rating from the Better Business Bureau, it's no wonder so many small business owners trust OnDeck as their lender of choice. Best for multiple types of loans: Biz2Credit · Best for same-day funding: OnDeck · Best for no prepayment fees: Funding Circle · Best for microloans: Kiva.

PNC Bank provides small business loans and financing options to help grow your business. Apply online today! The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses and is the most widely used loan program of the Small. The best banks offer a variety of business loans, including working capital, equipment, and CRE loans. See which banks offer the best small business loans. State-wide loan options for Florida small businesses · Florida Credit Union: Best for commercial auto loans · Pros · Cons · Florida Small Business Emergency Bridge. Small business loans can be used for working capital, payroll, equipment and more. Options include SBA loans, bank loans, term loans and lines of credit. The SBA helps small businesses get SBA loans by supporting them up to a certain loan amount. Find and apply for the Ink business credit card best suited for. Best Lender Comparison Site: Lendio · Best Revolving Line of Credit: Fundbox · Best for Microloans: Kiva · Best for SBA Loans: Fundera · Best for Same-Day Funding. Rockland Trust offers a variety of small business loans and financial solutions to help your enterprise grow. Learn more about a Small Business Loan for you. CDC Small Business Finance is the nation's top SBA lender, offering many small business loan products. What Are the Best Small-Business Loans? · Bluevine · Biz2Credit · Funding Circle · OnDeck · Rapid Finance · TD Bank · How Do Small-Business Loans Work? For a small business loan of $10, with a strong credit score, you might consider checking online lenders like Kabbage, OnDeck, or BlueVine. Wells Fargo. Wells Fargo is all about small business loans. They've actually set themselves a goal of $ billion loaned over five years to businesses with. See how small business loans from Funding Circle compare to SBA loans, bank loans, and other online lenders. Compare rates and terms today. Once approved, a small business loan advisor will reach out to you with the options you qualify for and help you choose the best business loan or financing. Truist is the result of a merger between SunTrust Banks and BB&T and is the only bank lender on our list. SBA loans don't fall into the alternative loan bucket. Big banking corporations like Bank of America and the U.S. Bank also provide loans to small businesses. Banks and SBA are considered to be traditional lenders. Banks offer the best rates and most flexible terms but have potentially strict qualification requirements. Companies must submit various documents, including. Alternative lenders include microlenders, online business loan providers and factoring companies. They might not offer competitive rates compared to a bank, but. The most common SBA loan offers flexibility on terms/uses and is a good option for acquisitions, partner buyouts, real estate purchases and refinance. Up to 90%.

Upcoming Share

Browse our list of upcoming and recent IPOs that you can invest in. Use our IPO Calendar to keep track of the most anticipated public offerings. Stay updated with the latest and upcoming IPOs in Watch IPO dates, listing dates, price range, and type. Monitor Mainboard, SME, and current IPOs. An IPO calendar with all upcoming initial public offerings (IPOs) on the stock market. Includes IPO dates, prices, how many shares are offered and more. A list of companies whose SET IPO applications are currently being reviewed. Company Splits, Company Splits Stocks, Company Splits Shares, List Of Company Splits - businessnewscurrent.online A complete list of all new equity issues including IPOs and money raised can be found in our Reports section which is available on News and Prices section. A. IPO - Initial Public Offering – Get a list of IPO in in India and watch Upcoming IPO details, listing date, lot size, price, allotment status. Stock Split Calendar. This calendar lists the recent and upcoming stock splits and reverse splits across all US stock markets. Learn more about upcoming IPOs at The New York Stock Exchange, which has a + year track record of supporting IPOs and innovating in the capital markets. Browse our list of upcoming and recent IPOs that you can invest in. Use our IPO Calendar to keep track of the most anticipated public offerings. Stay updated with the latest and upcoming IPOs in Watch IPO dates, listing dates, price range, and type. Monitor Mainboard, SME, and current IPOs. An IPO calendar with all upcoming initial public offerings (IPOs) on the stock market. Includes IPO dates, prices, how many shares are offered and more. A list of companies whose SET IPO applications are currently being reviewed. Company Splits, Company Splits Stocks, Company Splits Shares, List Of Company Splits - businessnewscurrent.online A complete list of all new equity issues including IPOs and money raised can be found in our Reports section which is available on News and Prices section. A. IPO - Initial Public Offering – Get a list of IPO in in India and watch Upcoming IPO details, listing date, lot size, price, allotment status. Stock Split Calendar. This calendar lists the recent and upcoming stock splits and reverse splits across all US stock markets. Learn more about upcoming IPOs at The New York Stock Exchange, which has a + year track record of supporting IPOs and innovating in the capital markets.

A complete list of all new equity issues including IPOs and money raised can be found in our Reports section which is available on News and Prices section. A. New Stock Listings Today: Get latest information about Initial Public Offering (IPO), Offer for Sale (OFS), Institutional Placement Program (IPP). Upcoming IPOs on the ASX (Australian Stock Exchange) today detailing companies seeking to list on the share market via an initial public offering. Upcoming IPO ; P · Premier Energies IPO. Premier Energies Ltd ; E · Ecos (india) mobility & hospitality pvt ltd IPO. Ecos (I) Mobility & Hospitality Ltd ; B · Bajaj. Discover the upcoming stock splits and their scheduled dates with the TipRanks stock splits calendar. The split ratio indicates how many new shares a. An Initial Public Offerings (IPO) is the process of offering shares of a private company to the public in a new issuance of stock. An IPO is an important time. Initial Public Offering (IPO) - Get latest information about news on recent & upcoming IPOs, Recent IPO News, New IPO News, IPO News Today, IPO News. Share, Cash, Updated, Mutual fund, IPO, Company, Banks, Hydro power, Online Upcoming Issues. IPO; Right Share; FPO; IPO-Local; Mutual Fund; Bonds. Here is the list of upcoming stock splits in India. These companies have announced their stock split recently. Upcoming IPOs in India - Invest in new, latest IPOs online and stay informed about issue dates, allotment, ipo issue size, ipo price, and other key. Check all the latest IPO details and recently listed IPOs in Get the new IPO calendar on Groww. The upcoming IPOs in India this week and coming weeks are Indian Phosphate IPO, Jay Bee Laminations IPO, Premier Energies IPO, Paramatrix Technologies IPO, ECO. To help you plan your IPO investments better, check the upcoming IPOs in Big names like Puranik Builders, FabIndia, TVS Supply Chain Solutions and Oravel. For information on participation in IPOs please contact the company, or the company's share registry. A-C. D-K. Ilala Metals Limited - 25 September Stay updated with the latest and upcoming IPOs in Watch IPO dates, listing dates, price range, and type. Monitor Mainboard, SME, and current IPOs. SHARE is an independent association user group providing IT and Upcoming Webcasts · Webcast Replays · Sponsor a Webcast · Security and Compliance. For information on participation in IPOs please contact the company, or the company's share registry. A-C. D-K. Ilala Metals Limited - 25 September Learn about the top upcoming initial public offerings (IPOs), why the IPO market was down big in and , and what to expect for the IPO market. Investors have more to look forward to, as well, with several upcoming IPOs likely to roll out over the next several months. In , the IPO market continued. To help you plan your IPO investments better, check the upcoming IPOs in Big names like Puranik Builders, FabIndia, TVS Supply Chain Solutions and Oravel.

What Is Fha Loan Interest Rate

FHA-insured mortgages are available with a % down payment for borrowers with credit scores of or higher. FHA loans are well-suited for home buyers who. FHA Loans ; %, %, % ; %, %, % ; %, %, % ; %, %, %. Today's FHA Mortgage Rates As of September 1, , the average FHA mortgage APR is %. Terms Explained. FHA Loan benefits are just the beginning · % down payment option · More flexible credit guidelines · Rates as low as % (% APR). For example, a year FHA loan at an interest rate of % on a home priced at $, will have a $2, monthly loan payment plus a $ monthly mortgage. As of January 25, , the national average year FHA mortgage interest rate was %, indicative of the prevailing economic conditions and policy decisions. Additionally, the current national average year fixed FHA mortgage rate remained stable at %. The current national average 5-year ARM FHA mortgage rate. Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. · year FHA Fixed-Rate Loan. FHA-insured mortgages are available with a % down payment for borrowers with credit scores of or higher. FHA loans are well-suited for home buyers who. FHA Loans ; %, %, % ; %, %, % ; %, %, % ; %, %, %. Today's FHA Mortgage Rates As of September 1, , the average FHA mortgage APR is %. Terms Explained. FHA Loan benefits are just the beginning · % down payment option · More flexible credit guidelines · Rates as low as % (% APR). For example, a year FHA loan at an interest rate of % on a home priced at $, will have a $2, monthly loan payment plus a $ monthly mortgage. As of January 25, , the national average year FHA mortgage interest rate was %, indicative of the prevailing economic conditions and policy decisions. Additionally, the current national average year fixed FHA mortgage rate remained stable at %. The current national average 5-year ARM FHA mortgage rate. Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. · year FHA Fixed-Rate Loan.

FHA loan interest rates can be more competitive than conventional mortgages but will vary depending upon the “Key Factors” listed above. The current FHA loan rate for a year fixed FHA purchase loan is %, based on an average of over FHA loan lenders, banks and credit unions. For. For instance, if your credit score is and you qualified for a loan with % interest, your monthly payment might be $ on a $, house. A credit. Current FHA mortgage rates are % for a 30 year fixed rate loan and % for a 15 year fixed loan ; 30 Year Fixed Rate · % ; 15 Year Fixed Rate · % ; 5/1. At U.S. Bank, with a credit score of or higher, you can apply for an FHA mortgage with a down payment of % of the loan amount. Talk with a U.S. Bank. The FHA loan interest rate is the amount of interest you pay on your loan each year, as mentioned above, but your APR includes the interest rate plus broker. Do FHA loans have lower interest rates? FHA mortgage rates tend to be lower than conventional loans because they are backed by the Federal Housing. With an FHA year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines. You may also be able to streamline. FHA mortgage rates are typically lower than conventional loan rates, or at least very close to them. But it's hard to compare conventional and FHA interest. FHA Loans allow lower credit scores, smaller down payments (as low as percent), cheaper closing costs, and more. Lower interest rates. Because FHA Loans. Interest Rate As Low As. Purchase: % for Year Fixed. Refinance: % for Year Fixed. % for Year Fixed. % for 7/6 ARM Year ; APR As. Today's FHA Loan Rates ; % · % · Year Fixed · %. Rates on FHA loans have moved around a lot in recent years — from less than 3 percent during the pandemic to 8 percent in October For most of early The interest rate is set by the lender and determined according to your credit history, size of down payment, and the housing market values. When it comes to. MIPs range from % to % of the loan balance on a year FHA loan and % to % of the loan balance on a year FHA loan. *The cases are calculated without the Hecm Loan numbers. Endorsement Fiscal Year. Endorsement Month. 1. 2. 3. 4. 5. 6. 7. 8. 9. Total. Average. FHA loans usually come with higher interest rates than conventional mortgages and require borrowers to purchase mortgage insurance. FHA loans also have strict. Lower down payment requirements are another advantage of FHA loans, but the amount you save depends on the quality of your credit score. FHA loan applicants. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from businessnewscurrent.online FHA. Optimal Blue, Year Fixed Rate FHA Mortgage Index [OBMMIFHA30YF] Mortgage Rates Interest Rates Money, Banking, & Finance. Releases. More Series.

Dollar Rate Today India Rupees

US Dollars to Indian Rupees conversion rates ; 1 USD, INR ; 5 USD, INR ; 10 USD, INR ; 25 USD, 2, INR. Find the current US Dollar Indian Rupee rate and access to our USD INR converter, charts, historical data, news, and more. Download Our Currency Converter App ; 1 USD, INR ; 5 USD, INR ; 10 USD, INR ; 20 USD, 1, INR. USD to INR Currency (USD to INR) Exchange Rate - Last 10 Days ; Aug ; Aug ; Aug ; Aug ; Aug Further Information United States Dollar - Indian Rupee ; Close, , Open, Daily Low ; USD · $ , $ , $ INR ; INR · $ , $ , $ USD. US Dollars to Indian Rupees: exchange rates today. USD. INR. 1 USD, INR. 10 USD, INR. 20 USD, 1, INR. 50 USD, 4, INR. USD, 8, Today businessnewscurrent.online 26/08/, for 1 US Dollar you get Indian Rupees. Change in USD to INR rate from previous day is %. Moreover, we have also added. Currently, 1 USD stands at approximately INR How Can I Convert US Dollar to INR in India. Some common ways to exchange US Dollar currency with INR in. US Dollar/Indian Rupee FX Spot Rate INR=:Exchange ; Open ; Prev Close ; Day High ; Day Low US Dollars to Indian Rupees conversion rates ; 1 USD, INR ; 5 USD, INR ; 10 USD, INR ; 25 USD, 2, INR. Find the current US Dollar Indian Rupee rate and access to our USD INR converter, charts, historical data, news, and more. Download Our Currency Converter App ; 1 USD, INR ; 5 USD, INR ; 10 USD, INR ; 20 USD, 1, INR. USD to INR Currency (USD to INR) Exchange Rate - Last 10 Days ; Aug ; Aug ; Aug ; Aug ; Aug Further Information United States Dollar - Indian Rupee ; Close, , Open, Daily Low ; USD · $ , $ , $ INR ; INR · $ , $ , $ USD. US Dollars to Indian Rupees: exchange rates today. USD. INR. 1 USD, INR. 10 USD, INR. 20 USD, 1, INR. 50 USD, 4, INR. USD, 8, Today businessnewscurrent.online 26/08/, for 1 US Dollar you get Indian Rupees. Change in USD to INR rate from previous day is %. Moreover, we have also added. Currently, 1 USD stands at approximately INR How Can I Convert US Dollar to INR in India. Some common ways to exchange US Dollar currency with INR in. US Dollar/Indian Rupee FX Spot Rate INR=:Exchange ; Open ; Prev Close ; Day High ; Day Low

The best rate to send Indian Rupee from US Dollar to your loved ones in India is currently offered by Abound; their 1 USD to INR exchange rate today is USD/INR: Indicative Sale Rate ; less than $2,, ; $2, to less than $5,, ; $5, to less than $25,, ; $25, to less than $, Historical Prices for Indian Rupee ; 08/23/24, , ; 08/22/24, , ; 08/21/24, , ; 08/20/24, , Convert US Dollar to Indian Rupee with the latest USD to INR exchange rate, fees, and trend analysis with Instarem US. US Dollar to Indian Rupee conversion ; USD, 8, INR ; USD, 20, INR ; USD, 41, INR ; USD, 83, INR. This Free Currency Exchange Rates Calculator helps you convert US Dollar to Indian Rupee from any amount. Get latest 1 Dollar to INR rates, Dollar to Rupee conversion rates, USD INR Forex rates, USD INR rate forecast, Dollar vs rupee historical rates. This page features the USD/INR cross. Get up to date statistics, analysis, charts and more on the US Dollar - Indian Rupee cross. What is the current USD (Dollar) to INR (Rupee) Conversion Rate Today? US Dollar to Indian Rupee Exchange Rate is at a current level of , down from the previous market day and up from one year ago. Download Our Currency Converter App ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 20 INR, USD. The current rate of US Dollar to INR is The expected High Low is % For 1 US Dollar, you would receive roughly INR INR 1 = $ INR = $ Today's current currency conversion rate of Dollar to INR is 1 USD = INR. So if you have INR then divide / = dollars. Thus, you will. USD to INR Selling Rate Today In India ; Mumbai, ₹ ; New Delhi, ₹ ; Chennai, ₹ ; Bangalore, ₹ As per today's exchange rate i.e. Sunday 25/08/, 1 US Dollar is equals to Indian Rupees. Change in USD rate from previous day is %. In case you. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. Current exchange rate US DOLLAR (USD) to INDIAN RUPEE (INR) including currency converter, buying & selling rate and historical conversion chart. The exchange value of 1 USD in Indian Rupee is INR as on Aug How to convert 1 USD to INR with Paytm online. You can convert 1 United States Dollar to. Indian Rupee Exchange Rates Table Converter ; US Dollar, · ; Euro, · ; British Pound, · ; Australian. Check the currency rates against all the world currencies here. The currency converter below is easy to use and the currency rates are updated frequently. This.